Social Security Cola Increase Projections

The Social Security Cost-of-Living Adjustment (COLA) is an annual increase in benefits that helps protect the purchasing power of Social Security recipients against inflation. The 2025 COLA is highly anticipated, as it will impact millions of Americans who rely on Social Security for their income.

Factors Influencing the 2025 COLA Increase

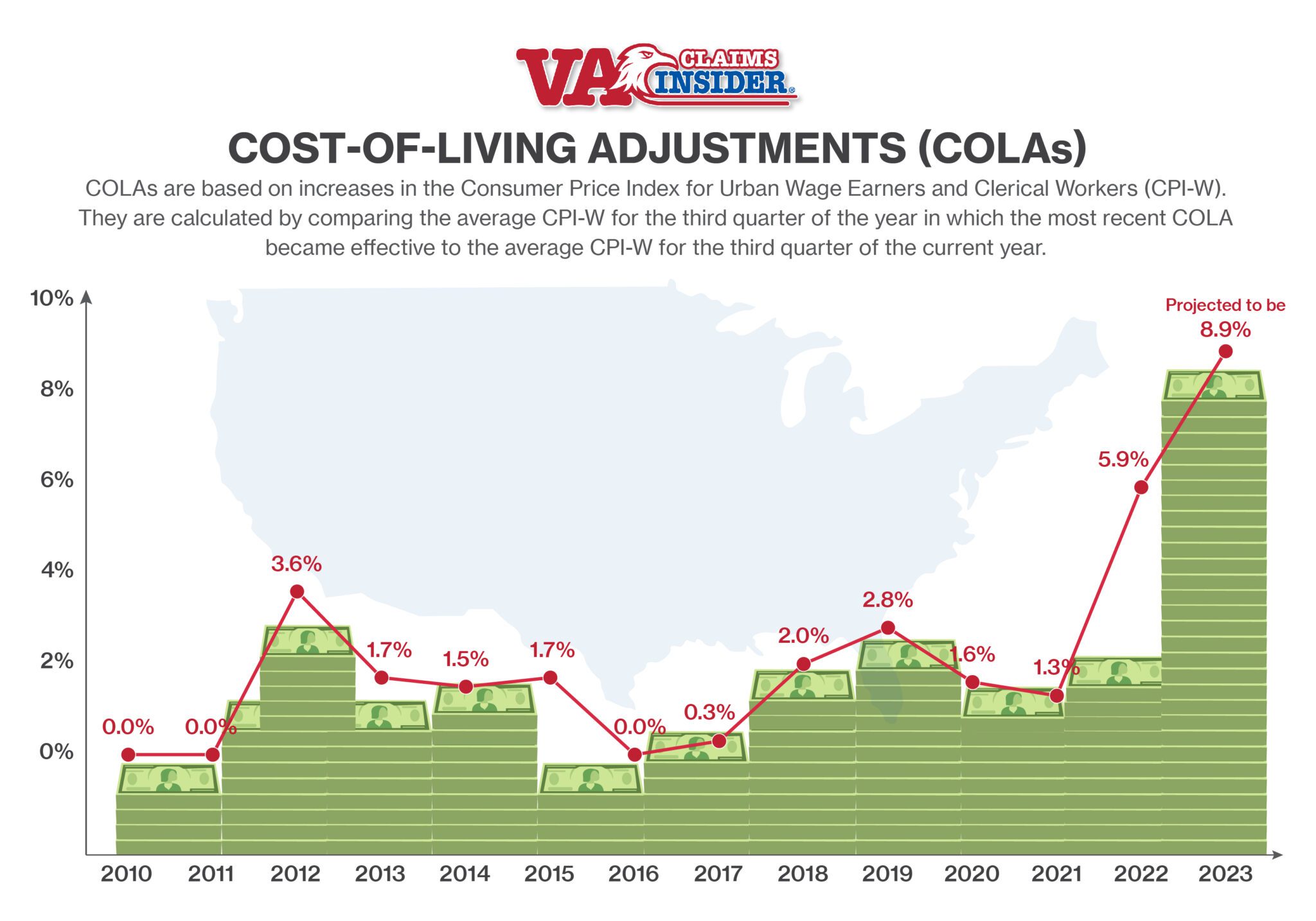

The COLA is calculated based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index measures changes in the prices of goods and services that are commonly purchased by urban wage earners and clerical workers. The COLA is equal to the percentage increase in the CPI-W from the third quarter of the previous year to the third quarter of the current year.

The 2025 COLA will be based on the CPI-W from the third quarter of 2024 to the third quarter of 2025.

Potential Range of the 2025 COLA Increase

Predicting the exact COLA increase for 2025 is challenging, as inflation rates can fluctuate. However, we can analyze historical trends and current economic conditions to estimate a potential range.

- In recent years, the COLA has ranged from 1.4% to 8.7%.

- The 2023 COLA was 8.7%, the highest in over 40 years, reflecting high inflation during the previous year.

- However, inflation rates have started to moderate in 2023, and economists are projecting a slower rate of inflation in 2024.

- Based on these factors, the 2025 COLA could be in the range of 2% to 4%.

Comparison of Projected COLA Increase to Inflation Rates

The goal of the COLA is to maintain the purchasing power of Social Security benefits. However, if the COLA increase is lower than the inflation rate, beneficiaries may experience a decrease in their real income.

- If inflation remains higher than the projected COLA increase, Social Security recipients may find that their benefits do not cover the rising costs of goods and services.

- This could lead to a decline in their standard of living, as they may have to reduce their spending or rely on other sources of income.

- On the other hand, if the COLA increase exceeds inflation, beneficiaries could experience an increase in their real income.

Impact of the 2025 COLA Increase on Beneficiaries

The projected Social Security Cost-of-Living Adjustment (COLA) for 2025 will impact beneficiaries in various ways, depending on their individual circumstances. This increase, if realized, could provide much-needed relief to those struggling with rising inflation, but it also presents potential challenges and opportunities that need to be considered.

Financial Implications for Different Beneficiary Groups

The 2025 COLA increase will have different financial implications for various groups of beneficiaries, including retirees, disabled individuals, and survivors. The impact of the COLA increase on beneficiaries’ financial well-being will depend on factors such as their current income level, living expenses, and other sources of income.

Retirees

The projected COLA increase could provide a much-needed boost to retirees’ incomes, helping them maintain their standard of living in the face of rising inflation. For example, a retiree receiving a monthly benefit of $2,000 could see their monthly benefit increase by approximately $200, representing a 10% increase. This additional income could help retirees cover rising costs for essentials such as food, housing, and healthcare.

Disabled Individuals

Disabled individuals rely on Social Security benefits as a primary source of income. The 2025 COLA increase could provide crucial financial support, allowing them to better manage their living expenses and maintain their quality of life.

Survivors

Survivors who rely on Social Security benefits to support themselves and their families could also benefit from the projected COLA increase. The increase could help them cover essential expenses and provide financial stability, especially for families with children.

Potential Challenges and Opportunities

While the 2025 COLA increase offers potential benefits, it also presents some challenges and opportunities for beneficiaries.

Increased Purchasing Power

The COLA increase could lead to increased purchasing power for beneficiaries, allowing them to afford more goods and services. For example, a retiree might be able to purchase more groceries or pay for home repairs with the additional income.

Potential Changes in Eligibility for Other Programs

The COLA increase could potentially affect beneficiaries’ eligibility for other government programs, such as Medicaid or SNAP. This is because some programs have income limits, and an increase in Social Security benefits could push beneficiaries over those limits.

Impact on Overall Financial Well-being, 2025 social security cola increase

The 2025 COLA increase could have a significant impact on the overall financial well-being of beneficiaries. It could help many beneficiaries maintain their standard of living, particularly those who are struggling with inflation. However, it’s important to remember that the COLA increase is not a guarantee of financial security. Beneficiaries should still budget carefully, plan for future expenses, and consider other sources of income to ensure their financial stability.

Policy Implications and Future Considerations: 2025 Social Security Cola Increase

The 2025 COLA increase, while providing much-needed relief to beneficiaries, raises critical questions about the long-term sustainability of the Social Security program. The increase, driven by inflation, could strain the program’s finances and necessitate adjustments to ensure its long-term viability. Examining the policy implications and future considerations surrounding this increase is crucial for understanding the program’s trajectory and its impact on future generations.

Impact on Social Security’s Long-Term Sustainability

The 2025 COLA increase will undoubtedly impact the Social Security program’s financial health. Higher benefits translate to increased outlays, which, in turn, could exacerbate the program’s projected long-term deficit. This potential strain highlights the need for careful consideration of policy options to ensure the program’s sustainability.

The Social Security Board of Trustees projects that the program’s trust funds will be depleted by 2034, leading to a reduction in benefits if no action is taken.

The impact of the 2025 COLA increase on the program’s long-term sustainability will depend on various factors, including the rate of inflation, future economic growth, and the effectiveness of any policy adjustments. The need for a balanced approach, encompassing both addressing the short-term needs of beneficiaries and ensuring the program’s long-term solvency, becomes critical.

Government Policy’s Role in Determining COLA Increases

The government plays a crucial role in determining COLA increases through legislation and policy decisions. The Social Security Act mandates annual cost-of-living adjustments based on the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W). This index measures inflation in consumer goods and services, driving the COLA increase.

The COLA is calculated as the percentage increase in the CPI-W from the third quarter of the previous year to the third quarter of the current year.

Government policy decisions can impact the COLA increase in various ways. For example, changes to the CPI-W formula or the inclusion of additional factors in the calculation could influence the COLA’s magnitude. Furthermore, policymakers could explore alternative methods for adjusting benefits, such as indexing them to wages instead of inflation.

Challenges and Opportunities Related to COLA Increases

The 2025 COLA increase presents both challenges and opportunities in the context of demographic changes and economic trends. The aging population, with a growing number of retirees, will exert increasing pressure on the program’s finances. Additionally, economic uncertainties, such as rising inflation and potential recessions, could impact the program’s ability to meet its obligations.

- The increasing life expectancy and aging population contribute to higher benefit payments and a shrinking workforce contributing to the Social Security trust fund.

- Economic downturns can lead to reduced payroll tax revenue, further straining the program’s finances.

- Rising inflation can erode the purchasing power of benefits, making it difficult for beneficiaries to maintain their standard of living.

Despite these challenges, the 2025 COLA increase also presents opportunities. It can help mitigate the impact of inflation on beneficiaries, ensuring their financial security. Furthermore, it can provide a platform for addressing the program’s long-term sustainability through policy reforms that balance the needs of current and future generations.

2025 social security cola increase – The 2025 Social Security cost-of-living adjustment (COLA) is a crucial factor for millions of Americans relying on the program. While the exact percentage increase remains unknown, analysts predict it will be influenced by various economic factors, including inflation and the performance of the stock market.

Similar to the rise of alex highsmith in the NFL, the 2025 COLA will likely be a significant development for many Americans, impacting their financial security and purchasing power.

The 2025 Social Security cost-of-living adjustment (COLA) is a hot topic for many Americans, particularly those relying on these benefits for their income. While the exact percentage increase remains uncertain, many are looking to the strong performance of young stars like alex highsmith , a standout linebacker for the Pittsburgh Steelers, as a sign of hope for the future.

The COLA’s impact on millions of recipients will depend on the overall economic climate, and the anticipation is high for its official announcement in the coming months.